Written by Bankers without Boundaries and Alan MacKenzie

Mission Cities have ambitious plans to become climate neutral – but the means of financing them will have to be just as innovative and bold. Experts from NetZeroCities’ partner Bankers without Boundaries have crunched the numbers and set out the challenges for Mission Cities in a recent paper.

We must fully grasp the magnitude of the investment required for cities to deliver their climate neutrality plans – because without that clarity, they risk falling short. The estimated €307bn (or €5,486 per person) needed across 100 Mission Cities isn’t just a big number – it’s a signal of the scale of transformation ahead.

The financial challenge is not a matter of scarce capital. Public, private, and philanthropic funding is available. What cities lack is the ability to absorb that capital: to make the most of it they will need technical expertise and the capacity to prepare viable projects that are ready for investment. These gaps are what stand between ambitious climate commitments and tangible, on-the-ground change. Financial experts Bankers without Boundaries (BwB) have calculated the €307bn incremental investment gap based on a detailed analysis of 28 Investment Plans, which are an integral element of each Mission City’s Climate City Contract.

How much will it cost each city to become climate-neutral?

The average planned capital expenditure – or CapEx, which is spending on major long-term assets, rather than day-to-day expenses – per Mission City included in the analysis is €3.4bn, equating to around €98bn across 28 cities. Modelling for the 72 other cities adds a further €209bn, for a total of €307bn. This translates to €7,341 per citizen within our sample of 28 cities, compared to an estimated €5,486 per citizen across all 100 EU Mission Cities.

While this figure is daunting, cities are not expected to bear this alone.

Based on verified Investment Plans of the 28 cities, and after checking for exceptional cases that can distort the data, we established in our report that funding will be split on average between roughly 10% municipal funding and 90% non-municipal funding.

Using this figure to estimate the total need across the 100 Mission Cities in the EU, approximately €277bn will therefore need to come from non-municipal sources, which range from grant funding and loans from the European Investment Bank (EIB) to investments from infrastructure, pension and insurance funds.

City Investment Plans show that municipal funding will focus mostly on built environment and transport initiatives, where the average planned investment in transport from the 28 cities studied was €0.7bn, covering, for example, bus fleet electrification, electric vehicle (EV) infrastructure, and cycle paths. Around €1.8bn on average was planned for built environment initiatives such as retrofitting buildings and energy efficiency upgrades. However, even in sectors where municipalities are expected to play a lead role, the BwB report notes that “primarily non-municipal financing will meet the funding gap.”

Can cities afford not to deliver their plans?

These huge sums can be hard to fathom. But while the costs of delivering climate initiatives may seem incomprehensible, a clear and important economic consideration is ‘opportunity cost’ – in other words, the cost of not doing something.

Leaving aside the known consequences of not acting to improve the climate (for example, the adverse effects and costs arising from flooding, wildfires, extreme weather, etc.), we can look at the estimated benefits that would be brought to the 100 EU Mission Cities by closing the funding gap and implementing the planned projects.

The opportunity cost of inaction is therefore not just environmental – it’s economic.

The huge estimated cost of €307bn may seem steep, but it is outweighed by the total projected benefits, out of which operational savings alone – in other words, direct benefits – are expected to total €308bn.

And that’s just the start. When indirect economic benefits, often referred to as co-benefits, such as cleaner air, improved public health, and increased urban mobility are included, the total benefit rises to €394bn – equivalent to a net gain of €87bn, or around €1,500 per citizen. The report shows that for every €1 invested, cities stand to gain at least €1.28 in direct and indirect returns, making this not only a climate necessity but a compelling economic case.

Source: BwB

How can cities find the money?

With the support of partners such as the EIB and experts from NetZeroCities, Mission Cities have an advantage when it comes to attracting the outside investment they need to pay for their climate plans.

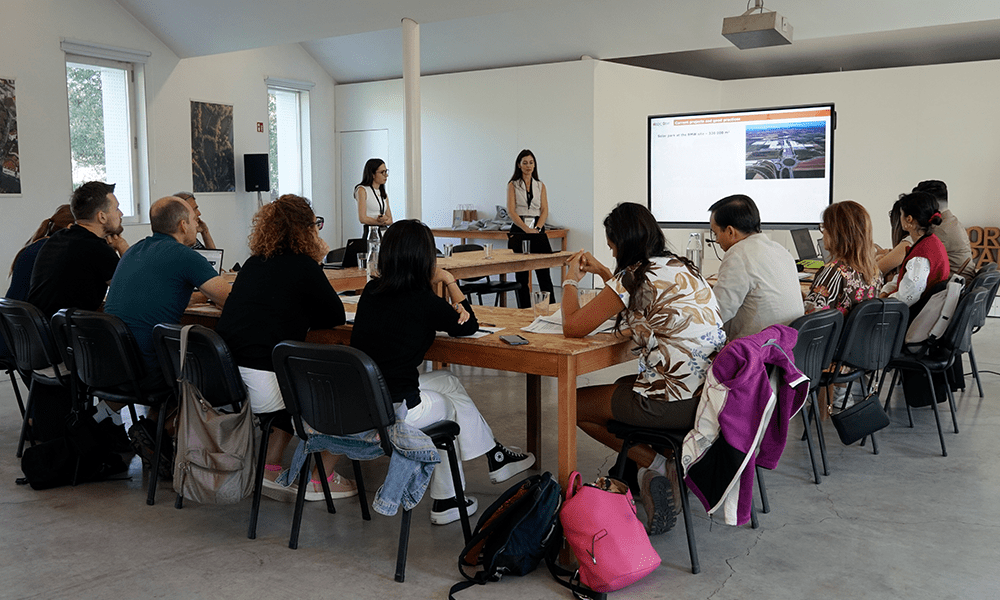

Through the Climate City Capital Hub, Mission Cities have access to financial specialists who can help cities identify and secure funds from non-municipal sources.

Investing for the (not-too-distant) future

“Mission Cities are already ahead of the curve. Through the Capital Hub and support from European institutions, they’re getting tailored financial advice and access to tools that can turn ambitious climate plans into investable projects. That gives them an edge,” says Delphine Queniart, Director of Climate City Capital Hub.

Leuven, in Belgium, is one city to have benefited from this support. The city’s ambitious Climate City Fund (currently being prepared) aims to mobilise private and public resources across a portfolio of investments.

This is critical for projects that could make a large impact on a city’s climate neutrality goals but might offer less financial reward for investors. Presenting them in a package that includes more attractive initiatives means they can be supported or ‘cross-financed’ by these higher returns.

Technical assistance provided by the Capital Hub has included:

- Supporting the city in developing a strategy for early pipeline development, and designing the fund’s structure, as well as matching these two strategies with available funding opportunities.

- Input into the Enabling City Transformation (ECT) application call, an 18-month, grant-supported, NetZeroCities initiative to facilitate transformative climate action in cities by through innovation, which allowed the city to secure €600,000 to cover set-up and pipeline development costs for the fund, particularly in the field of district heating.

“Leuven’s Climate City Fund is bringing a version of a fund structure that is mainstream in private capital markets into the hands of the city as a powerful fundraising and investment tool,” says BwB’s City Finance Specialist for Belgium, UK and Ireland, Alvar Gener. “This is an ambitious challenge for which bridge funds – such as those provided by the ECT funding – are crucial.”

Klagenfurt in Austria is another city to have benefited from Capital Hub support. Its programme for investing in electric buses had some support from a national scheme, but the city needed a long-term lender, as well as a quick loan to make up a shortfall.

Technical assistance provided by the Capital Hub included:

- Identification of immediate fund providers via a bridging loan, to be repaid by national funding programmes.

- A standard financial model to establish potential returns and identify potential investors.

- An offer to support policy advocacy to help secure financing in a difficult financial environment.

Valladolid in Spain was one of the first cities supported by the Capital Hub, providing assistance on the city’s environmental restoration project on the Pisuerga River, aimed at strengthening the river’s social and economic value.

Technical assistance came from the EIB, while the Capital Hub assessed financing options for the project. The Hub also assisted the city with determining the best approach in seeking to use four municipal sports centre roofs in energy community projects.

“In Valladolid, we were able to quickly identify where capital was needed and how to unlock it, whether for natural restoration or innovative energy community projects,” says Blanca Rincon de Arellano, City Finance Specialist for Spain and Portugal. “The Mission Label helped open doors, and our role was to bring structure and strategy to that opportunity.”

“We’re only at the beginning. The Capital Hub will continue working with Mission Cities to refine their financial strategies, crowd in private investment, and advocate for enabling frameworks at national and EU levels,” says Delphine Queniart.

“The need is urgent – but the capacity is growing and exciting, impactful initiatives lie ahead.”